Economic Confidence Survey – Spring 2018

European business leaders remain positive on the global business outlook and support multilateral trade negotiations

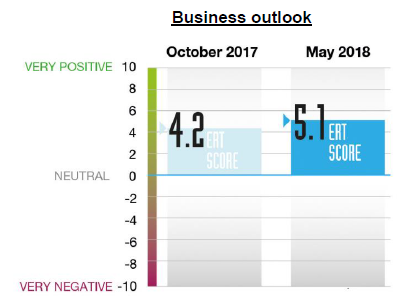

The second Economic Confidence Survey commissioned by the European Round Table of Industrialists (ERT) shows that Europe’s business leaders remain positive. The general business outlook slightly increased compared to October 2017, when the survey was carried out for the first time. (see graph)

In total 52 CEOs and Chairman of Europe’s leading industrial companies replied to the survey. (i.e. a response rate of 96%)

- Some 81% of the respondents expect a moderate or significant increase of sales outside Europe alongside continued growth in Europe, albeit at a slightly slower pace compared to October 2017.

- Investment expectations remain positive. 51% indicate that capital investment will stay about the same in Europe and 35% expect an increase, showing somewhat less optimism compared to October 2017. Outbound investment plans are more expansionary: 61% report that investment will increase outside Europe.

- The respondents expect increased employment within their company both inside (35%) and outside (52%) Europe. Expectations for increased employment inside Europe (35%) are higher than in October 2017 (15%).

In the light of the recent US tax reform, ERT Members were asked how European tax legislators should react to preserve European companies’ competitiveness. Some 52% said the priority should be on bringing down effective tax rates in Europe. 37% favour targeted tax incentives for investments; a clear message that tax systems in Europe need to be modernised. 37% support international tax harmonisation at OECD level.

With regards to global tendencies towards protectionism in different regions, 87% favour multilateral trade diplomacy, and 60% bilateral trade negotiations. 38% support the idea of systematically addressing citizens’ legitimate concerns regarding globalisation.

The survey was conducted by the Centre for European Economic Research (ZEW).