Europe’s business leaders would ‘choose Europe’, if Draghi Report is fully implemented

- 86% of CEOs & Chairs in ERT believe that full implementation of the Draghi Report would improve conditions in their sector

- 80% would invest in the EU rather than elsewhere within 3 years, if report recommendations are fully implemented

- Simplifying regulation and resolving Single Market fragmentation are considered the top priorities for VDL2

- Economic confidence among CEOs & Chairs deteriorates, though impact coming in the next 6 months

Brussels, 28 November 2024: A newly published survey of business leaders in the European Round Table for Industry (ERT) reveals fading economic confidence in Europe, tempered with hope that the incoming EU policy cycle will set an ambitious future direction for the European economy that can reinvigorate investment.

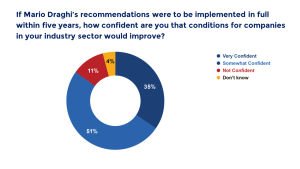

The latest edition of The Conference Board Measure of CEO Confidence™ for Europe by ERT survey included a number of special questions on the recommendations in Professor Mario Draghi’s report¹ The Future of European Competitiveness. A large majority of CEOs and Chairs surveyed (86%) believe that if implemented within the new European Commission’s term, the Draghi Report would improve conditions in their sector.

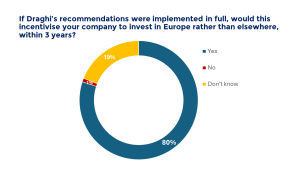

Crucially, 80% of respondents said that if the report’s recommendations are implemented in full, they would invest in Europe over any other location, within the next 3 years.

These responses reflect the belief that these business leaders have in their home market, if the incoming European Commission and 27 national governments in European Council pursue a sufficiently audacious programme to make the EU more competitive vis-à-vis other countries and world regions.

Simplification and Single Market

The motivation to invest again in Europe comes from three drivers, creating clear expectations where the incoming European Commission needs to target its ambitions.

With responses of 86% and 62% respectively, simplification of the regulatory environment and deepening the Single Market are the highest priorities for business leaders. They reflect clear horizontal action points from the Draghi Report.

Implementing the report’s more specific recommendations for a successful and competitive decarbonisation of Europe’s industry will also be important in motivating and unlocking investment.

1

Economic Confidence

This 15th edition of the semi-annual survey gauged sentiment among these corporate leaders during October. Views were collected between 9 and 23 October 2024.

Overall, business confidence fell from a cautiously optimistic 58 in the first half of the year to a relatively bleak 47 this time. The measure ranges from 0 to 100. A reading above 50 reflects more positive than negative responses. CEOs’ views on their company’s sales, investments and employment situation outside of Europe remained strong at 60, while domestically it has stagnated from a neutral 50 six months ago to 49.

Maria Demertzis, Economy, Strategy and Finance Center Leader, Europe, The Conference Board commented “European CEOs have welcomed the recommendations by the recent report on how to improve the EU’s competitiveness, and have clearly expressed how these should be prioritised. The important remaining question is how many of these recommendations will be implemented –– and against what time horizon. With confidence declining among the Chairs and CEOs of some of Europe’s largest companies, there is clearly some urgency.”

Other topics addressed in this latest survey included questions on EU-China relations and the geopolitical developments that pose the greatest risks to business. To download the full survey results, click [here].

About the survey

The Conference Board Europe and ERT have collaborated on a Measure of CEO Confidence™ for Europe since 2020. The semi-annual surveys poll the Members of the European Round Table for Industry (ERT) – the CEOs and Chairs of some leading European industrial and technology companies with operations worldwide.

The measure is based on results from three survey questions about: 1) business and economic conditions now; 2) conditions in six months; and 3) prospects for respondents’ own industries. These questions have been asked by The Conference Board in an equivalent survey in the United States on a quarterly basis since 1976. The survey is conducted twice a year in Europe and twice yearly in China.

In addition to the confidence measure, CEOs and Chairs also assess the outlook for their own company through questions about employment, sales, and capital investment, inside and outside Europe. ERT has fielded these survey questions since the second half of 2017. Special questions of current significance are included in each survey. The response rate to this latest survey was 92%, amounting to some 55 CEOs and Chairs participating in the survey.

****

Note to Editors:

A full list of the membership of ERT is accessible here.

¹ The Future of European Competitiveness by Prof. Mario Draghi, September 2024

Responding to the accelerating urgency to tackle Europe’s evolving lack of competitiveness, the Draghi Report has set a clear direction for the incoming European Commission. In the recent Budapest Declaration, national governments across the EU recognised that ambitious joint action is required. In case there is any doubt - the latest survey results spell out our position loud and clear: full implementation of the Draghi Report will be transformative, providing the platform to make Europe the most attractive destination for investment – and set a basis for business leaders to invest again in Europe. This is a strong message to governments across the EU-27 who know that they have been elected to make things better, to provide jobs, growth and prosperity.