Europe’s energy transition: ERT releases analysis on the EU’s competitiveness for energy-intensive industries and state of energy infrastructure

New ERT reports by Boston Consulting Group (BCG) lay out the state of play and articulate the challenges in Europe’s energy transition

Brussels, 9 April 2024: As the countdown continues to the European elections and appointment of the next European Commission later this year, the European Round Table for Industry (ERT) releases two reports focusing on the state of Europe’s energy transition.

The announcement of the Antwerp Declaration¹ in February, reiterated European industry’s commitment to the Green Deal’s climate goals while paving the way for a stronger business case in Europe. These new ERT reports, developed in partnership with the Boston Consulting Group (BCG) detail the many obstacles to overcome to make Europe sustainable, without further compromising its resilience and competitiveness.

1

2

Part 1: Can energy-intensive industry still thrive in Europe?

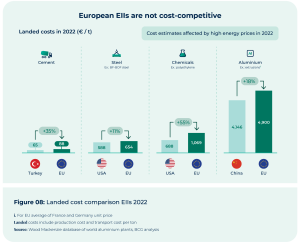

The first report, entitled “Competitiveness of the European Energy-Intensive Industries”, takes stock of the intense competitive pressure on European energy-intensive industries (EIIs), compared to their competitors elsewhere.

This publication lays bare Europe’s loss of competitiveness through energy transition, reflected in data, such as the loss of 66% of aluminium production in the EU and its recent reversal from being a chemicals exporter to a net importer. The risk of further deindustrialisation is evident in the shift of foreign direct investment (FDI) towards other regions. It also explores the reasons behind higher energy and decarbonisation costs, barriers to affordable renewable energy access and the importance of deploying future technologies.

Companies led by ERT Members are proposing regulatory changes and asking policymakers to rethink Europe’s policy pathways to achieve its climate targets:

- Ensure the availability and affordability of low-carbon energy and Carbon Capture, Utilisation and Storage (CCUS);

- Increase financial attractiveness of decarbonisation;

- Create a level playing field vs international competition.

Featuring quotes from Hilde Merete Aasheim (Norsk Hydro), Jean-Pierre Clamadieu (Engie), Pierre-André de Chalendar (Saint-Gobain), Stefan Doboczky (Heubach Group), Dr Ilham Kadri (Syensqo), Aditya Mittal (ArcelorMittal), Wael Sawan (Shell), Jim Snabe (Siemens) and Jakob Stausholm (Rio Tinto), the full report can be downloaded here.

Part 2: The Infrastructure Imperative

With the imperative of industrial decarbonisation, the surge in demand for renewable energy has put enormous strain on existing infrastructure. The energy mix at play in the system has also shifted, so massive investments are needed in both national and cross-border infrastructure for power grids, hydrogen and CO₂.

The second report, “Strengthening Europe’s Energy Infrastructure”, details the pain points and infrastructure investments still needed to deliver one of the core pillars of the Green Deal: abundant availability of competitively priced renewable energy across the EU.

To achieve this decisive and fundamental transformation, the investment gap requires collaborative effort between public and private capital: €0.8 trillion needed by 2030, scaling to €2.5 trillion by 2050.

Expanding grids is as much, or even more, a global challenge as it is an EU-wide challenge. The EU is in a privileged situation, as it has one of the largest interconnected grids in the world, but also an underdeveloped Single Market for energy; these ambitions need further support through regulatory actions.

Companies led by ERT Members are proposing regulatory changes and asking policymakers to rethink Europe’s policy pathways to achieve its climate targets:

- Ensure the availability and affordability of low-carbon energy and Carbon Capture, Utilisation and Storage (CCUS);

- Increase financial attractiveness of decarbonisation;

- Create a level playing field vs international competition.

Featuring quotes from Hilde Merete Aasheim (Norsk Hydro), Jean-Pierre Clamadieu (Engie), Pierre-André de Chalendar (Saint-Gobain), Stefan Doboczky (Heubach Group), Dr Ilham Kadri (Syensqo), Aditya Mittal (ArcelorMittal), Wael Sawan (Shell), Jim Snabe (Siemens) and Jakob Stausholm (Rio Tinto), the full report can be downloaded here.

Part 2: The Infrastructure Imperative

With the imperative of industrial decarbonisation, the surge in demand for renewable energy has put enormous strain on existing infrastructure. The energy mix at play in the system has also shifted, so massive investments are needed in both national and cross-border infrastructure for power grids, hydrogen and CO₂.

The second report, “Strengthening Europe’s Energy Infrastructure”, details the pain points and infrastructure investments still needed to deliver one of the core pillars of the Green Deal: abundant availability of competitively priced renewable energy across the EU.

To achieve this decisive and fundamental transformation, the investment gap requires collaborative effort between public and private capital: €0.8 trillion needed by 2030, scaling to €2.5 trillion by 2050.

Expanding grids is as much, or even more, a global challenge as it is an EU-wide challenge. The EU is in a privileged situation, as it has one of the largest interconnected grids in the world, but also an underdeveloped Single Market for energy; these ambitions need further support through regulatory actions.

Europe’s ambition for a greener future calls for a decisive evolution of its energy infrastructure. With regard to the development and rollout of next generation energy infrastructure, the Members of ERT recommend:

- Fast-track energy infrastructure development

- Facilitate more cross-border cooperation via transnational PPAs

- Address any market reform with a preliminary impact assessment study

- Incentivise both on- and off-shore interconnector planning

- Encourage harmonisation of technical standards for more interconnection

- Ensure strategic locations for demand centres for hydrogen and CO2

- Accelerate permitting.

As a result, this transition would not only deliver sustainable power in a reliable and economical way to end users, but also drive growth and create jobs.

3

Featuring insightful expert case-studies from Air Liquide, ArcelorMittal, ENGIE, Eni, Ericsson, Iberdrola, Maersk, Nokia, Shell, Siemens, Volvo Group, the report articulates the state of play in European energy infrastructure, the gaps that need to be addressed and ERT’s recommendations to the next European Commission and Energy Council.

In developing this report, BCG interviewed ERT Members at the forefront of energy infrastructure in Europe, so this report includes quotes from Leonhard Birnbaum (E.ON), Jean-Pierre Clamadieu (ENGIE), Claudio Descalzi (Eni), Pekka Lundmark (Nokia), Martin Lundstedt (Volvo Group), Patrick Pouyanné (TotalEnergies) and Jim Snabe (Siemens). The full report can be downloaded here.

4

****

Note to Editors:

* A full list of the Membership of ERT is accessible here: https://ert.eu/members/

** For more information on ERT’s work on Energy Transition & Climate Change see here: https://ert.eu/focus-areas/energy-and-climate-change/

*** To learn more about the climate targets & projects under way at companies led by Members of ERT, visit https://industry4climate.eu

Decarbonisation through energy transition has gone from being a purely European ambition to become a global agenda. That is a positive development, in view of how the climate crisis is a global one, so all progress in containing and reducing global emissions is welcome. However, it’s also become obvious that the methodologies being deployed by the EU, the US, China and others vary enormously – and that here in the EU, the biggest risk of the European approach is that it has put energy-intensive industry at a significant competitive disadvantage.

Europe has leading companies in energy-intensive sectors such as cement, chemicals, metals and refining, employing millions of people and feeding various upstream and downstream industries vital to our autonomy and security. If Europe’s share of these global sectors is lost, others from elsewhere will simply pick it up and that prosperity will go there. With this in mind, we commissioned these reports to compile and assess how the European energy transition is advancing, its effect on energy-intensive industries and how on-track we are for an energy future that will have a greater share of electricity and hydrogen.

Infrastructure modernisation is where the rubber hits the road in the Green Deal, yet policymakers are not doing enough to enable the real delivery of the targets they have set. Companies of all shapes, sizes and sectors need to be reassured of the delivery of the infrastructure that will underpin the promised efficiencies and stability of the EU’s net-zero future. The incentives to attract much needed private investment are not there yet, so policymakers should tackle this urgently.

Just like Ernest Hemingway’s famous line about bankruptcy, the energy transition will also happen “gradually then suddenly”. At some point, it will be clear which region or country has won the race to decarbonise – and enjoy the respective competitive advantages. The next five years will determine that, so we hope these comprehensive reports will inform the next Commission’s work programme to implement the Green Deal.