Reduced appetite to invest in Europe due to lack of business case puts renewed pressure on policymakers

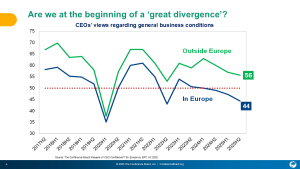

CEO Confidence is no longer in freefall but remains negative in Europe, whilst US, China fare better.

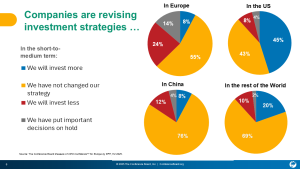

Business case for investing in Europe is weakening further: since the last survey, only 8% of CEOs will invest more in Europe than planned, whilst 38% reduced their investment plans or put decisions on hold.

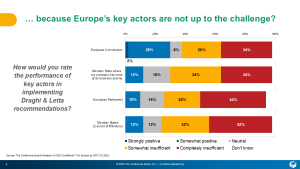

EU is too slow to implement transformative policies – business leaders most critical of performance of national governments and the European Parliament to push reform

The latest The Conference Board Measure of CEO Confidence for Europe by ERT survey (conducted in October) reveals that while the freefall in CEO confidence has been arrested, Europe is attracting less investment, especially in comparison to the US. Leaders of key European industry and technology companies are alarmed at the lack of urgency in delivering on Draghi and Letta’s bold reforms to restore the business case for investing in the bloc.

A snapshot of the outlook for business investment in Europe

Confidence has improved, but remains negative: The CEO Confidence Measure for Europe has climbed to 44, up from a historic low in Spring, when EU-US trade tensions plunged Confidence to a historic low of 27. However, this is the first time that confidence has stayed in negative territory for three consecutive editions — well below the neutral threshold of 50.

Recovery abroad, but not in Europe: The gap is widening between Europe and abroad as business conditions outside Europe are improving, whilst the business climate in Europe is on a downwards trajectory – notably due to poor prospects for investment and employment.

‘Why choose Europe?’ – Go West: For Europe, only a small majority of CEOs expect to stick to their investment plans, and a mere 8% intend to invest more than they planned six months ago. Over a third, however, will invest less than planned or have put decisions on hold. The US, on the other hand, now attracts more investment than planned by 45% of CEOs.

Europe is wasting a good crisis

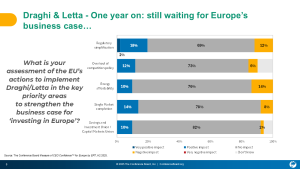

This time last year, 80% of business leaders in ERT expressed enthusiasm for Mario Draghi’s recommendations to restore the EU’s competitiveness. That survey* found that if Draghi’s recommendations were fully implemented, CEOs would invest back into Europe rather than elsewhere. Such optimism one year ago contrasts with today’s reality where a striking 76% of CEOs have so far seen little or no positive impact from EU initiatives to implement Draghi and Letta in critical areas: regulatory simplification, Single Market completion, competition policy and energy affordability.

Industry is disappointed by the performance of all European institutions in delivering on Draghi and Letta’s reform recommendations. The European Commission has delivered enough to convince 30% of CEOs, but yet disappoints 60%. However, business leaders are even more disillusioned by the European Parliament and national governments in the EU-27 – dissatisfaction peaks for the latter, with 74% of CEOs declaring that performance in implementing Draghi and Letta is insufficient.

Simplification and technology to save the day

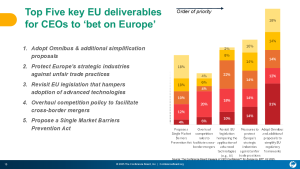

As in all previous surveys, Simplification leads the list of policy actions to restore Europe’s competitiveness: 90% of CEOs rank regulatory simplification as a top-five priority for the EU, with 31% naming it the number one issue. This needs to be complemented by protecting strategic industries and revisiting legislation to accelerate AI and advanced technology adoption. Also of high priority are overhauling competition policy and introducing a Single Market Barriers Prevention Act.

1

Maria Demertzis, Economy, Strategy and Finance Center Leader, The Conference Board Europe noted “CEO confidence is recovering from historical lows, but views remain gloomy as CEOs see limited impact of reform efforts. However, CEOs have been pessimistic about Europe for a year and a half and they see a brighter outlook for their business outside the continent, with the gap between business conditions in Europe and outside widening significantly. Increased uncertainty worldwide is leading to most companies not changing investment strategies in Europe and other geographies. However, and despite uncertainty, close to half of companies have revised plans to invest more in the US. CEOs continue to emphasise the need for reforms and ask countries to take concrete action to strengthen the business case for our continent.”

This latest survey was conducted by the Conference Board between 16–31 October 2025, so its findings do not include reaction to the European Commission’s recently released Digital Omnibus.

The full report by the Conference Board can be downloaded here.

************

* Find the survey results release from H2 2024 here: https://ert.eu/documents/surveyh22024/

About the survey

The Conference Board Europe and ERT have collaborated on a Measure of CEO Confidence™ for Europe since 2020. The semi-annual surveys poll the Members of the European Round Table for Industry (ERT) – the CEOs and Chairs of some leading European industrial and technology companies with operations worldwide.

The measure is based on results from three survey questions about: 1) business and economic conditions now; 2) conditions in six months; and 3) prospects for respondents’ own industries. These questions have been asked by The Conference Board in an equivalent survey in the United States on a quarterly basis since 1976. The survey is conducted twice a year in Europe and twice yearly in China.

In addition to the confidence measure, CEOs and Chairs also assess the outlook for their own company through questions about employment, sales, and capital investment, inside and outside Europe. ERT has fielded these survey questions since the second half of 2017. Special questions of current significance are included in each survey. The response rate to this latest survey was 94%.

About ERT

The European Round Table for Industry (ERT) brings together around 60 Chief Executives and Chairs of major multinational companies of European parentage, covering a wide range of industrial and technological sectors. ERT strives for a strong, open, and competitive Europe as a driver for inclusive growth and sustainable prosperity. Companies led by the Members of ERT have operations worldwide, with combined revenues exceeding €3 trillion, providing around 6 million direct jobs worldwide – of which half are in Europe – and sustaining millions of indirect jobs. They invest more than €120 billion annually in R&D, largely in Europe. Members lead companies headquartered in the European Union, Norway, Switzerland and the UK.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. TCB.org

The results of this latest survey spell out problems that are often levelled at Brussels: a lack of speed and focus on the collective European interest. CEOs are now calling out national governments in the European Council for doing the least to implement the recommendations of the Letta and Draghi reports. Current geopolitics and geo-economics mean Europe has no time to waste to restore its competitiveness and prosperity. The stakes are too high now to hide behind the cliché of ‘blaming Brussels’. No single country in the EU can weather the current geopolitical and economic climate on its own. And Europe’s model can only be maintained if, as a community, we get back on an economic growth path.