Amid geopolitical uncertainty and stalling growth, CEOs urge EU-27 to swiftly advance Single Market completion

- CEO Confidence drops across the globe: in Europe, China and the US.

- European CEOs observe a decline in the investment climate in USA since the start of the year and unpredictability in China.

- Faced with a highly unpredictable global environment, CEOs believe Member States should support EU efforts to deepen the Single Market and bolster scale.

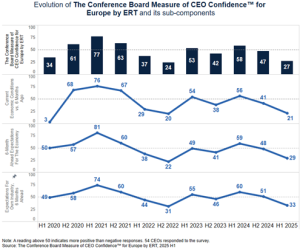

Brussels, 4 June 2025: The latest survey of business leaders in the European Round Table for Industry (ERT) reveals CEO confidence across Europe continues its decline. The Conference Board Measure of CEO Confidence™ for Europe, derived from a poll taken in April, nears the historic lows last seen during the energy shock of autumn 2022, triggered by Russia’s invasion of Ukraine. The new drop coincided with the US administration’s announcement on unprecedented tariff measures on imports from its global trading partners.

Confidence has been hit in the three biggest global markets

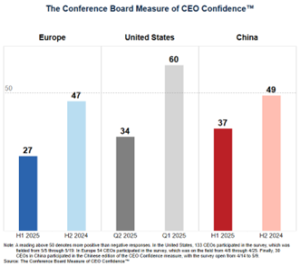

CEO confidence in the US and China has also taken a hit. The Conference Board Measure of CEO Confidence™ for the US fell by 26 points in the second quarter of 2025, the largest quarter-over-quarter decline in the history of the US survey, which started in 1976. In parallel, China-based CEOs of western companies adjusted their expectations from a stagnation scenario to a deterioration, although the fall in confidence is less pronounced than in Europe or the US.

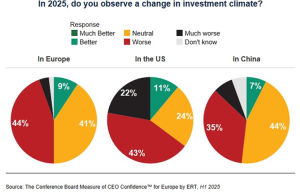

Local CEOs’ loss of confidence in the US and China is echoed by European CEO’s observations on the investment climate in these key markets. From a European vantage point, the investment climate is deteriorating most severely in the US, with a negative-to-stable outlook in Europe and a stagnated-to-negative outlook for China.

Can European companies still rely on external markets for growth?

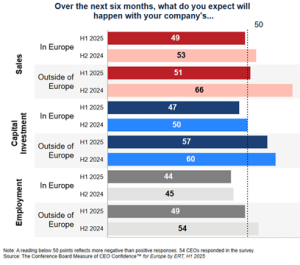

In Europe, the plunge in confidence is driven by deteriorating prospects across companies’ sales, employment and investment – both within Europe and abroad. But while in the past business activities abroad could be relied on to compensate for ‘sluggishness’ in the European home market, the latest survey indicates that this may no longer be the case. Sales abroad – previously a confidence driver – are now especially threatened by stagnation.

1

Single Market – break down existing barriers, to create new possibilities & prosperity

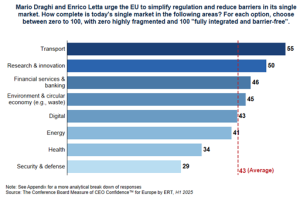

On 21 May, the European Commission announced its plans for deepening the EU Single Market by removing some of the remaining barriers to internal trade and mobility. In the H1 2024 report, 73% of CEOs said that completing the Single Market quickly would be a gamechanger for Europe’s growth, competitiveness, prosperity and resilience. In the latest report, the immense potential of the renewed Single Market push is underlined by CEOs’ perception that across sectors, Single Market integration is far from complete. In only two areas – transport, and research and innovation – do CEOs believe that the Single Market is more integrated than fragmented.

The Single Market will also be essential to Europe’s security and defence-readiness by 2030. When asked how policymakers can help the defence industry deliver on scale and innovation, CEOs sent a very strong signal that Europe needs to think big and ‘as one’!

Creating a EU Single Market for defence products and services holds the greatest promise for strengthening Europe’s defence industrial base. EU-level efforts to create European champions can yield a bigger and better result than national initiatives focused on national champions.

2

Maria Demertzis, Economy, Strategy and Finance Center Leader, Europe, The Conference Board “CEOs are having to deal with an increasingly uncertain geopolitical and trading environment, which they are struggling to navigate. The decline in confidence in US and China markets as alternative drivers of growth for European businesses presents an opportunity for European policymakers to attract more investment to the continent. But to do so, they will need to deliver quickly on deregulation and single market integration, while responding effectively to external tariffs in a way that is coherent and predictable.”

To download the full survey results, click here.

ENDS

About the survey

The Conference Board Europe and ERT have collaborated on a Measure of CEO Confidence™ for Europe since 2020. The semi-annual surveys poll the Members of the European Round Table for Industry (ERT) – the CEOs and Chairs of some leading European industrial and technology companies with operations worldwide.

The measure is based on results from three survey questions about: 1) business and economic conditions now; 2) conditions in six months; and 3) prospects for respondents’ own industries. These questions have been asked by The Conference Board in an equivalent survey in the United States on a quarterly basis since 1976. The survey is conducted twice a year in Europe and twice yearly in China.

In addition to the confidence measure, CEOs and Chairs also assess the outlook for their own company through questions about employment, sales, and capital investment, inside and outside Europe. ERT has fielded these survey questions since the second half of 2017. Special questions of current significance are included in each survey. The response rate to this latest survey was 91.6%, amounting to some 55 CEOs and Chairs participating in the survey.

****

Note to Editors:

A full list of the membership of ERT is accessible here.

¹ Read the release for the Autumn Measure of Confidence Survey Results here.

² The Future of European Competitiveness by Prof. Mario Draghi, September 2024

Since the semi-annual Confidence Measure surveys (of ERT Members) were introduced in 2020, CEO Confidence has been hit by major global ‘events’ taking their toll on economies and businesses. The implications are clear: Local demand is increasingly important for Europe’s industry to grow and better withstand disruption – whether from conflict or shifts in international policy. Last autumn’s CEO Confidence Survey underlined business leaders’ conviction that the full implementation of the Draghi and Letta Reports is the right way to pursue this. Events this Spring are further proof that Europe needs to move forward together fast with a constructive agenda. The time to overcome national obstacles is now.”

For Europe’s future competitiveness and resilience, scale will be critical to attract the investments needed to transform our economy and make it fit for an uncertain future. The Single Market offers the key to deliver this. All eyes are on Europe’s political leaders – in Brussels and in capitals – to see whether they will act with speed and pragmatism. For too long Europe has ‘made the perfect the enemy of the good’ – now any improvement to the Single Market counts: for goods, services, capital, people and defence. Europe must seize the opportunity to be greater than the sum of its parts, curbing national reflexes and keeping it simple. Needs must.