Confidence rebounds among European business leaders, yet their prospects are better outside Europe

- Business confidence among Europe’s CEOs & Chairs returns to its highest level since May 2022

- CEOs concerned that Europe-China bilateral relations will continue to deteriorate, reflecting several friction points

- CEOs crystal clear on what incoming EU leadership should do to restore competitiveness

- Europe’s leaders are not doing enough to improve defence capabilities

Brussels, 29 May 2024: Business confidence among CEOs and Chairs of many of Europe’s largest companies rebounds to the highest level since May 2022. And yet, industry leaders are markedly more positive about their companies’ business outlook outside Europe than within.

The Conference Board Measure of CEO Confidence™ for Europe by ERT polls Members of the European Round Table for Industry (ERT) – the CEOs and Chairs of some of Europe’s best-known industrial and technology companies with operations worldwide. This 14th edition of the semi-annual survey gauged sentiment among these corporate leaders on topics including the economic outlook, ways to restore Europe’s competitiveness and the Europe-China relationship.

Overall, business confidence (on a scale of 0 to 100) improved from a relatively pessimistic 42 six months ago, to a cautiously optimistic 58 in the first half of 2024. The increase in confidence is due primarily to improving sentiment around short-term economic conditions.

1

2

China-Europe relationship – as seen from Europe, and from within China

The issue of Europe’s falling competitiveness must also be viewed through the lens of its shifting dynamic with China. This latest edition of the survey included a number of special questions on the quality and friction points of Europe-China relations. The responses received reflect an expectation that this critical relationship will remain challenging for foreseeable future.

A majority of business leaders in Europe (54%) believe that relations with China are set to worsen in the next three years, while only 7% expect an improvement (39% anticipate no change). In parallel, China-based CEOs of western multinationals were also surveyed during the same period by The Conference Board. They are somewhat more optimistic about the future of EU-China relations: 35% expect the relationship to worsen, 19% count on an improvement and 45% predict no change.

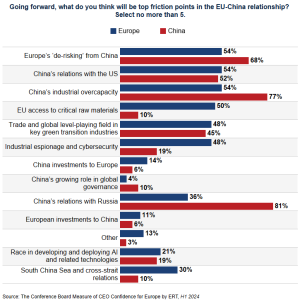

CEOs believe that China’s relations with the US will deeply influence China-Europe relations. 54% of CEOs in Europe see China-US relations as a top-five friction point for the EU-China relationship. An almost identical share of China-based CEOs (52%) agree with that assessment. An almost identical share of China-based CEOs (52%) agree with that assessment. China’s industrial overcapacity is moreover seen as a top friction point by 54% of Europe’s CEOs and by a striking 77% of China-based CEOs.

From a European perspective, other factors driving tension include Europe’s derisking from China, China’s dominance in critical raw materials, and trade and a global level-playing field in key green transition industries.

Viewed from Chinese soil, China’s relationship with Russia tops the list of causes for friction, with 80% of China-based CEOs citing it as a top-5 friction point in the relationship between the two regions.

3

Improving EU regulation is the greatest lever to restore competitiveness

Across sectors and company sizes, Europe’s business community is urging its political leaders to take Europe’s accelerating loss of competitiveness much more seriously, and to recognise the extent of its threat to Europe’s prosperity and global relevance. After the European elections, leaders will need to focus on bringing about a step change in policy – and they need to do so in a way that has rapid and real impact.

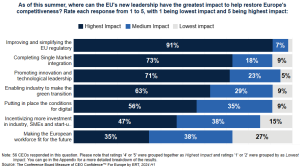

When asked to point out the highest-impact strategies available to EU leaders to restore competitiveness, an overwhelming 91% of CEOs highlight that improving and simplifying the EU’s regulatory environment would be the most effective policy lever. The finding follows CEOs’ near-unanimous views in the autumn 2023 survey that complex and incoherent regulation is the number one risk-factor impeding European competitiveness.

Almost three-fourths of CEOs (73%) view actions to advance Single Market integration as having a substantial positive impact on Europe’s competitiveness – fully in line with Enrico Letta’s recent call to deepen the Single Market. This is followed by promoting innovation and technological leadership, with 71% of CEOs believing further European action in this area would have a positive impact on European competitiveness – and a message that needs to resound when EU leaders are discussing the next Framework Programme for Research and Innovation. Enabling industry to accelerate progress on climate objectives (63% of CEOs), and putting in place the conditions for digital transformation (56% of CEOs) round out the top five to-do list for EU leaders.

Self-defence: Europe’s leaders are not doing enough to secure defence capabilities

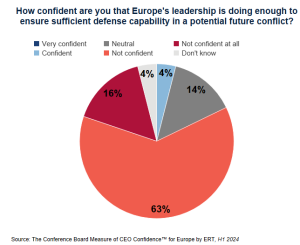

When Europe’s CEOs were asked about the Europe’s ability to defend itself against aggression, not a single respondent said they are “very confident” that Europe’s leadership is doing enough to ensure sufficient defence capability. Only 4% say they are “confident”. Instead, the vast majority of CEOs (79%) say they are either “not confident” or “not confident at all.” Another 16% have a “neutral” stance on the matter, and 4% say they “don’t know.”

This result echoes the findings of the most recent Eurobarometer survey**, in which citizens put security and defence as the top priority for the EU in the next five years.

“Although it is good news that confidence has returned among Europe’s CEOs, for the first time, we have seen the gap in CEO confidence regarding business prospects inside Europe and outside Europe grow significantly,” said Sara Murray, Managing Director, International, The Conference Board.

“Across capital investment, employment and sales, CEOs are significantly less optimistic about the future inside Europe than abroad. CEOs are clear that Europe’s hurdles are due to cumbersome regulation, failures to fully integrate the single market, and timidity on technological leadership. With tensions with China expected to worsen and Europe’s defence capabilities creaking, incoming European policymakers have some very significant challenges ahead of them.”

****

A full list of the membership of ERT is accessible here.

** For more on the Eurobarometer results: Standard Eurobarometer 101 – Spring 2024 – May 2024 – – Eurobarometer survey (europa.eu)

The Conference Board and ERT have collaborated on a measure of CEO Confidence for Europe since 2020. The measure is based on results from three survey questions about: 1) business and economic conditions now; 2) conditions in six months; and 3) prospects for respondents’ own industries. These questions have been surveyed by The Conference Board in the United States on a quarterly basis since 1976. The survey is conducted twice a year in Europe.

In addition to the confidence measure, CEOs and Chairs also assess the outlook for their own company through questions about employment, sales, and capital investment, inside and outside Europe. ERT has fielded these survey questions since the second half of 2017. Special questions of current significance are included in each survey.

The latest survey was fielded between April 3 to April 25 2024, to 57 ERT members. Fifty-six replied to the regular questions, resulting in a response rate of 98%. At least 55 replied to the special questions. The Measure of CEO Confidence survey was circulated in China between April 9th to April 26th to 42 CEOs and Executives. The response rate was 72%.

To download the full survey results, click here.

Expectations seem to have adjusted to Europe’s more difficult new realities and on that basis we see a rebound in confidence. But we need to see this rebound for what it is: Leaders are optimistic for their companies’ investment and employment outside Europe – but within Europe expectations are a lot less bright.

As a place to do business, Europe seems stuck on a path of relative decline. This survey result echoes sentiment expressed time and again by people running businesses of all sizes, across the EU. Europe’s incoming leadership has to prioritise achieving a turnaround that puts competitiveness front & centre of the work programme from here to 2030.

The current climate of escalation between the US and China is adding new layers of complexity to global trade. Europe should have a voice of its own in trade matters striving for level playing fields and European competitiveness. One of the immediate challenges for incoming EU leaders will be to successfully calibrate EU trade policy to navigate the geopolitical tensions.