CEO confidence withers in Europe as regulation weighs down competitiveness

Europe’s corporate leaders pessimistic about prospects of short-term recovery in Europe

Brussels, 15 November 2023: Business confidence among CEOs and Chairs of many of Europe’s largest companies has fallen back into negative territory, reflecting current economic conditions and the weight of complex regulation on prospects for future growth.

The Conference Board Measure of CEO Confidence™ for Europe by ERT polls the Members of the European Round Table for Industry (ERT) – the CEOs and Chairs of some of the best-known European industrial and technology companies with operations worldwide. This 13th edition of the semi-annual survey gauged sentiment among these corporate leaders on a number of topics, including the economic outlook, Europe’s competitiveness and its regulatory environment.

Almost two thirds (61 percent) of CEOs and Chairs see the European economy performing worse than six months ago. Since the 12th edition, in April 2023, The Conference Board Measure of CEO Confidence™ for Europe has dropped from an anemic 53 to a pessimistic 42. The measure ranges from 0 to 100. A reading above 50 reflects more positive than negative responses.

All three subcomponents of the index are in negative territory, with current economic conditions versus six months ago seeing the steepest fall. Prospects for recovery over the next six months remain pessimistic, with 43 percent of respondents expecting a worsening economic outlook in the near term, and only 9 percent looking towards the next six months with optimism.

1

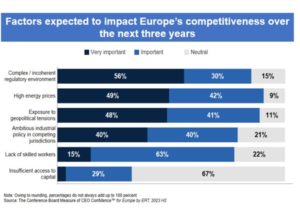

Complex and incoherent regulation now the number one risk-factor

In the spring 2023 survey, an alarming 84 percent of CEOs said that Europe’s competitiveness as a basis for industry was weakening. This latest survey followed up with a question on the factors behind this decline. Fifty-six percent believe that a ‘complex and/or incoherent regulatory environment’ will have a very important impact on competitiveness over the next three years, with an additional 30 percent seeing this impact as important. This is followed by other risk factors such as high energy prices and exposure to geopolitical tensions.

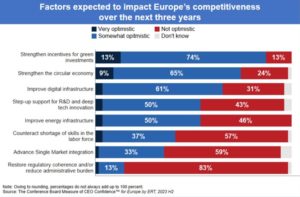

Yet, whilst a complex and incoherent regulatory environment is flagged as the greatest concern for Europe’s competitiveness, there is little optimism that policymakers will take ambitious action to tackle the complexity of Europe’s regulatory frameworks. More than eight out of ten (83 percent) of theindustry leaders surveyed expect no ambitious action to restore regulatory coherence and / or reduce the regulatory burden. Sentiment on Single Market integration revealed 60 percent of respondents do not have high hopes of seeing substantive progress being made on this. This result reflects the business community’s growing impatience with the lack of political capital being invested in renewing Europe’s Single Market.

Contrasted confidence in Europe’s green transition

The survey results reveal mixed confidence in the green transition moving from vision to reality at a pace that keeps up with Europe’s political targets.

On the bright side, 87 percent of the Members of ERT are either somewhat or very optimistic that EU policymakers will take ambitious action to strengthen incentives for green investments. Similarly, 74 percent expect to see policymakers launching new initiatives to support the circular economy, encouraging more reuse and recycling of materials and products. At least a slim majority of CEOs (54 percent) are optimistic that there will be policy action to improve energy infrastructure.

However, what about Europe’s ability to roll out of the green transition in real terms? When questioned about whether Europe has the right conditions to build the physical infrastructure needed, 70 percent of CEOs flag that they are not confident that administrative processes are fit to enable such projects. This is followed by a lack of confidence that Europe has sufficient skilled workers, cited by 59 percent of respondents.

Beyond Europe – the picture in the United States and China

The fall in economic confidence among European CEOs is mirrored in the United States and China. Although it is lowest in Europe in absolute terms, the decline is starkest in China. In the United States, the quarterly “The Conference Board Measure of CEO Confidence™ in collaboration with the Business Council” fell to 46 in Q4, down from 48 in the third quarter. More than two thirds of US CEOs (69 percent) continue to expect to see a shallow and brief US recession in the next 12 to 18 months, with limited global spillover.

China-based CEOs of European and US multinational companies remain slightly more optimistic than their peers in Europe and the US. The Measure of CEO Confidence™ for China remains in positive territory, at 54, but dropped strongly from a record-high of 72 six months ago. Following a surge in confidence after China lifted all COVID restrictions, the outlook has become more somber, with expectations of an entrenched period of slow economic growth.

“The economic picture in Europe is growing gloomier, with significant concerns about the state of European competitiveness” said Sara Murray, Managing Director, International, The Conference Board.

“Business leaders are telling us that Europe needs to take action to improve administrative processes for business and make more progress on Single Market integration. The green transition is obviously an area where Europe can compete globally, but there needs to be better regulation to make that a reality. Otherwise, European business leaders will choose to invest in China and other parts of Asia.”

About the survey

The Conference Board and ERT have collaborated on a measure of CEO Confidence for Europe since 2020.

The measure is based on results from three survey questions about: 1) business and economic conditions now; 2) conditions in six months; and 3) prospects for respondents’ own industries. These questions have been surveyed by The Conference Board in the United States on a quarterly basis since 1976. The survey is conducted twice a year in Europe.

In addition to the confidence measure, CEOs and Chairs also assess the outlook for their own company through questions about employment, sales, and capital investment, inside and outside Europe. ERT has fielded these survey questions since the second half of 2017. Special questions of current significance are included in each survey.

The latest survey was fielded between September 26 to October 11, 2023, to 56 ERT members. Fifty-four replied to the regular questions, resulting in a response rate of 95 percent. More than 50 replied to the special questions.

To download the full survey results, click here

Globally we find ourselves in a landscape of uncertainties – and it is only natural that this impacts confidence. But Europe is not coming at these multiple crises from a position of strength. Despite our great potential as an innovation leader and industrial base, our economy is struggling with internal challenges that will also worsen our prospects for the future. Incoherent and complex regulation came out as CEOs’ top risk to competitiveness in this survey. To change this, we urge the next European Commission and European Parliament to put the business case for EU industry and its competitiveness at the core of its actions. We need a clear and meaningful commitment that policymakers are determined to tackle this challenge head-on. And this has to happen very soon. We have no time to lose before irreparable damage is caused to Europe’s global competitiveness and the prosperity and ultimately the stability of our society.