Business confidence stabilises, but Europe’s competitiveness is on the decline

CEO Confidence returns to positive territory, but Europe’s competitiveness as a base for industry is weakening

Brussels, 23 May 2023: Today’s report reveals the latest sentiments for the economic and business outlook among European business leaders and reflects the challenges facing companies in Europe across a range of sectors.

The Conference Board Measure of CEO Confidence™ for Europe polls the Members of the European Round Table for Industry (ERT) – the CEOs and Chairs of some of the best-known European industrial and technology companies with operations worldwide. This 12th edition of the semi-annual survey gauged sentiment among these corporate leaders on various topics, including the economic outlook, investments, Europe’s competitiveness and the business consequences of current geopolitical tensions. The survey was conducted in mid-April.

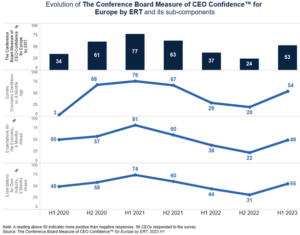

In terms of its scoring, The Conference Board Measure of CEO Confidence for Europe has increased from 24 in H2 2022, the lowest ever recorded by the survey, with a nudge into positive territory at 53 for H1 2023. The measure ranges from 0 to 100. A reading of more than 50 reflects more positive than negative responses.

Confidence has stabilised, but Europe’s competitiveness is weakening

The results of this round of the survey suggest that CEO confidence is stabilising after a very disruptive year marked by Russia’s invasion of Ukraine and record high energy prices. With a measure of 55, CEOs broadly project somewhat improved prospects for their own industries over the coming six months. However, this finding is tempered by their expectations for the performance of the European economy over the coming six months, which remain in negative territory at 49.

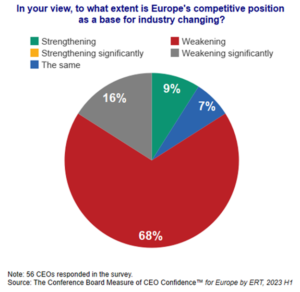

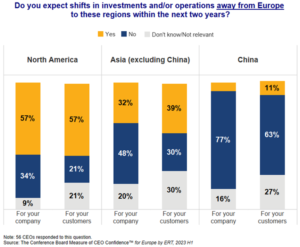

For Europe’s economic competitiveness, however, the findings are alarming. Over 80 percent of CEOs believe Europe’s competitiveness as a base for industry is weakening. And this perception also helps explain why nearly 60 percent of them plan to shift investments and/or operations from Europe to North America within the next two years.

1

2

The current complex environment also challenges the business competitiveness of Europe’s companies. CEOs see the most significant risk in geopolitical tensions, rising inflation and elevated energy prices linked to record levels of input costs. Moreover, these top three risk factors are interlinked and likely to persist. For example, in our last confidence survey (November 2022), most CEOs expected that energy prices would not return to pre-2020 levels in the foreseeable future.

Go West?

The survey results confirm that the US Inflation Reduction Act attracts European companies. Asian countries (other than China) also see a shift of investments or operations in their direction, potentially because of lower production costs.

However, very few CEOs are considering shifting investment and/or operations to China for their company. Moreover, nearly 80 percent do not intend to shift investments and/or operations away from Europe to China, despite indications that a post-pandemic recovery is beginning to develop some momentum there.

Skills shortages – a risk to the roots of competitiveness

Whilst the top three risks to business are exceptional and closely connected to geopolitical developments, the fourth risk is a slow-burning and home-grown challenge: skills shortages are very high on CEOs’ risk list for their company’s business competitiveness. The dual transition of green technologies and digital innovation appears to move faster than Europe’s workforce transition. This is coupled with an ageing workforce and a generally tighter labour market, creating a key concern for European businesses and executives.

In this area, ERT’s programme Reskilling 4 Employment (R4E) aims to address the need for reskilling by mobilising companies, trainers, public agencies and governments to help the unemployed and those at risk of unemployment to reskill and upskill into more in-demand professions.

3

Sara Murray, Managing Director, International, The Conference Board, added, “In our regular and intense interactions with the senior leaders of Europe’s largest businesses, we are seeing a growing emphasis on the critical importance of upgrading and expanding Europeans’ ability to handle the green, digital economy. AI and robotics are clearly accelerating automation in almost all sectors of our economy, but well-skilled employees will continue to be the driver for growth and economic success for many years ahead. This is an issue that we believe needs much greater and more urgent attention.”

To download the full survey results, click here. The next survey will be carried out in Q2, 2023.

The results of this latest survey put Europe’s competitiveness front & centre in the spotlight. The findings are clear and urgent evidence that Europe’s future as a leading base for industry remains at risk. Geopolitical tensions are having huge repercussions – and we in Europe are in the middle of this. So all of us – companies and policymakers alike – have to fight even harder to maintain our competitive edge and our leadership in innovation. Our people, our ideas and our Single Market are our natural assets – but they need better conditions to compete globally.

We can still turn this around – if our institutions and governments take up this challenge. The next survey will take place in the autumn – when the European Commission’s proposals to simplify and reduce reporting requirements by 25% are due to be announced – a step which will hopefully bring more optimism and make it easier for Europe to attract investment and jobs in all-important emerging sectors.

Europe needs to build a culture that normalises reskilling across professions – for companies and individuals. Digital education and skills are the backbone of Europe’s future prosperity. Through our R4E programme*, we are building a vehicle that can mobilise a massive effort to address the current skills gap in Europe. This is about providing European citizens at various stages of their careers with opportunities to reskill and secure current and future capabilities. Building on pilot programs in Portugal, Spain and Sweden, we continue to scale up in these countries and expand R4E to others. More news will follow in the course of the European Year of Skills launched earlier this month.